Bank of International Settlements (BIS) raises its Early Warning Indicators

Bank of International Settlements (BIS) raises its Early Warning Indicators

The Bank of International Settlements or more commonly known as BIS, had just published its highly respected research article raising concerns over its Early Warning Indicators (EWI) of Banking Crisis.

BIS believes that “Household and international debt (cross-border or in foreign currency) are a potential source of vulnerabilities that could eventually lead to banking crises.”

And BIS combines “these indicators with property prices” to create their proprietary analysis of global economies and the potential risks of vulnerabilities in countries.

Rationale behind EWIs

The rationale is rather simple to follow and very logical, at least to me, whereby BIS believes that their model of EWIs tend to capture advance warning signs of over-heated and over-bubbly financial booms that potentially and eventually lead to financial busts.

In their own words, BIS describes their logic,

“EWIs typically capture booms in the financial cycle in a stylised way. The notion of the financial cycle refers to the self-perpetuating sequence of financial expansions and contractions that can amplify business fluctuations (Minsky (1982), Kindleberger (2000), Borio (2014)). And outsize financial booms can lead to stress and even financial crises.”

For the true blue financial geeks out there, you can find the full article and their detailed analysis here.

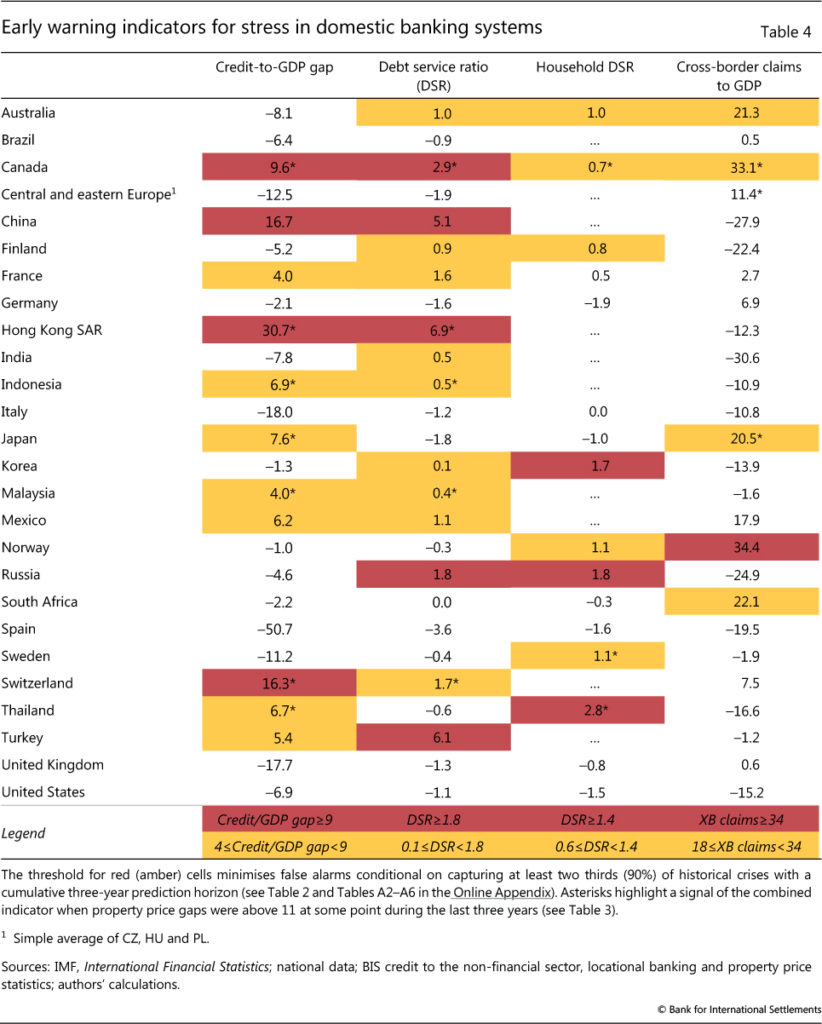

They ran their models looking at things like household credit-to-GDP gap and difference between household sector debt servicing ratio (DSR) and its 20-year rolling average.

And of course, as they are BIS, they ran their models against their BIS international banking and debt statistics, evaluating cross-border borrowing like foreign currency debt (domestic and cross border issuance) and property prices. Specifically, they look for rapid build up of household debts; abnormal DSR numbers; and frothy property price levels that are above their model thresholds.

What did BIS picked up in March 2018?

Based on their models, Canada, China and Hong Kong were red flags. Surprisingly, Singapore was not picked out. (kudos to our MAS and Government for keeping property prices in check and curbing unhealthy DSRs)

Economies like Switzerland, Russia and Turkey were also flagged for their Credit to GDP warning indicators. ASEAN members like Indonesia, Malaysia and Thailand, were highlighted in their property price gaps signal.

Conclusion

BIS stresses that these data suggests some concern but they urge users to interpret the indicators with caution (aka with a tinge of salt).

While their hypothesis is sound, the model works on past results and data, and does not consider new macro policies nor the fact that emerging economies have built up a significant reserves than during previous crisis.

That said, in my opinion it confirms one thing, property markets across the globe are going higher and in general credit ratios are trending higher in tandem.

Will this lead to a repeat of property crash induced financial busts? I’m not too sure, because things have changed since 10 or 20 years - Central Banks have built up a substantial amount of reserves, and emerging economies are definitely seeing real growth.

Will we see some form of correction in asset prices? Probably, the market will experience some correction and in most likelihood continue its upward trajectory till some unforeseen financial/political disaster suddenly happening and reversing the whole bullish momentum.

What do you think are the risks that we face in this 2018 and beyond?